The Sovereign Risk Paradox: Why Australian Data Residency Matters More Than Ever.

In today’s highly digital governance landscape, Australian Boards of Directors are expected to maintain an unyielding commitment to fiduciary duty. This obligation extends far beyond financial oversight; it now encompasses meticulous control over the company’s most sensitive strategic asset: its data.

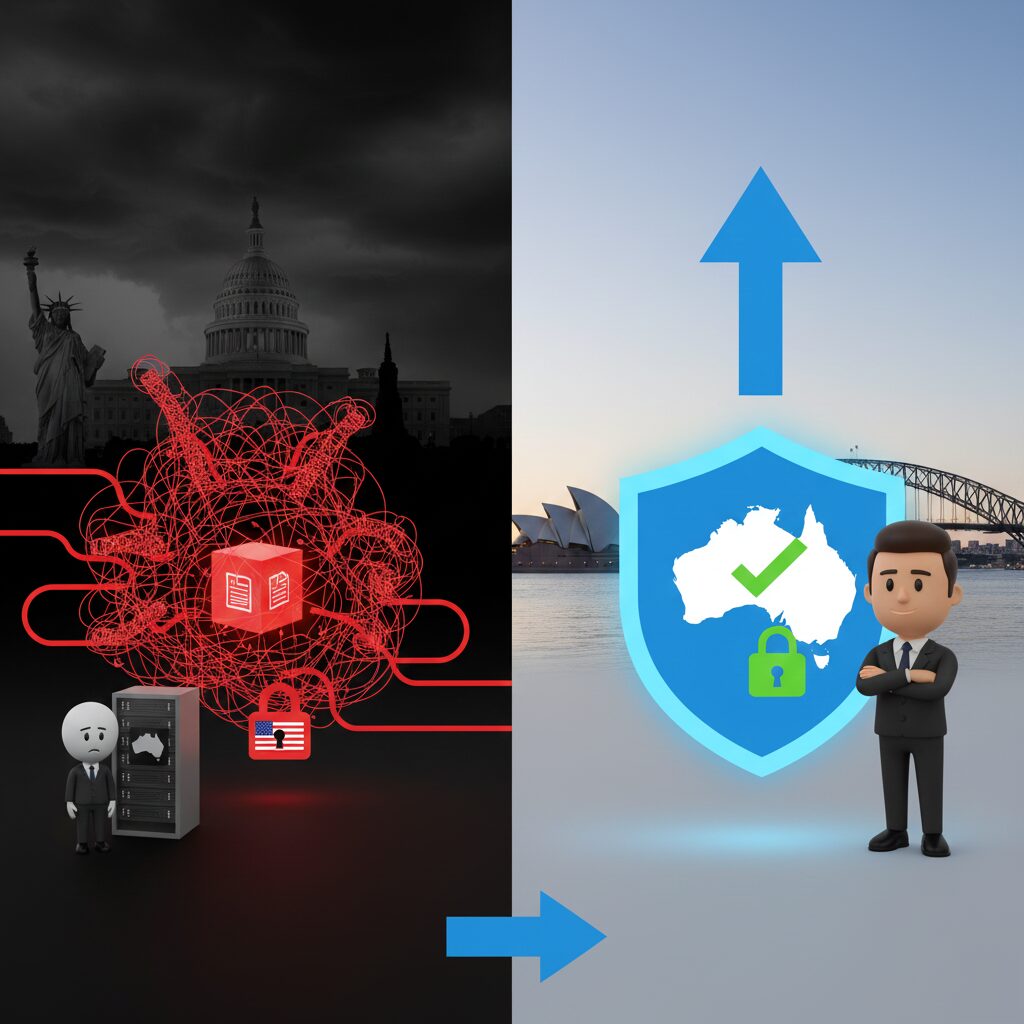

For Australian entities, particularly those regulated by APRA, ASIC, and the OAIC, the selection of a technology provider—such as a board portal—presents a critical risk known as the Sovereign Risk Paradox. This paradox is simple: choosing a sophisticated, cost-effective global vendor can inadvertently expose the company’s confidential information to the jurisdiction of a foreign government.

Defining the Paradox: Jurisdiction vs. Location

Many global technology providers assure Australian customers that their data is stored locally in a Sydney or Melbourne data centre. While this satisfies basic data residency requirements, it fails to address the far more crucial element: data jurisdiction.

The Sovereign Risk Paradox occurs when the physical location of the data (Australia) is overridden by the legal domicile of the vendor (e.g., the United States or Europe).

The Extraterritorial Threat: The CLOUD Act.

The most prominent example of this legal conflict is the U.S. Clarifying Lawful Overseas Use of Data Act (the CLOUD Act). This federal law empowers U.S. law enforcement to compel U.S.-headquartered technology companies to surrender data stored anywhere in the world, regardless of local sovereignty or foreign privacy laws.

For an Australian Board, this means their strategic plans, merger discussions, sensitive commercial dealings, and executive remuneration packages could be accessed under a foreign legal warrant—without the protection or appeal mechanisms afforded by Australian courts. For highly regulated sectors, such as financial services (subject to APRA’s CPS 231), this is an intolerable level of operational risk.

Why Australian Regulation Demands Local Control

Australian regulators expect Boards to maintain control over their critical data and operational resilience. The expectation is that data essential for Australian business continuity must remain subject to Australian legal and regulatory frameworks.

The decision to choose a locally domiciled provider eliminates this geopolitical vulnerability immediately. When the vendor is an Australian legal entity, the data stored on their servers is solely subject to the scrutiny of the Australian Federal Police, ASIC, and APRA. This simplifies the compliance burden and provides a defensible position for the Board.

The Ultimate Mitigation: Athena Board and Zero Knowledge

Mitigating the Sovereign Risk Paradox requires two simultaneous commitments:

- Jurisdictional Certainty: Selecting a board portal vendor that is incorporated, operated, and governed by Australian law.

- Technological Certainty: Demanding a security architecture that prevents anyone, including the vendor itself, from accessing unencrypted content.

This is the principle of Zero Knowledge or Zero Trust – a cryptographic framework where the vendor cannot retrieve the customer’s encryption keys, thus making compelled disclosure of unencrypted data impossible.

Athena Board, for instance, has been engineered specifically to address this paradox within the Australian market. By ensuring 100% Australian residency and operation and adhering to rigorous standards like ISO 27001 certification, Athena Board eliminates the risk of foreign legal compulsion. Furthermore, its commitment to a highly secure architecture ensures that the platform is not just compliant, but inherently protective of the Board’s sensitive fiduciary information.

The Governance Imperative

The contemporary director must treat data sovereignty as a fundamental aspect of risk management. The question for every Australian Board is no longer “Where is our data physically located?” but rather, “Under whose law does our data ultimately fall?”

Choosing an Australian-based solution is not merely a patriotic gesture; it is a fundamental act of due diligence that fortifies the company’s governance framework against the complexities of global politics and extraterritorial surveillance laws.

Athena Board can help, contact us now at sales@athenaboard.com.